Convertible Bonds: Review and Current Environment

We would like to present the performance of the H.A.M. Global Convertible Bond Fund compared to equities and bonds as of October 23, 2024 (net performance).

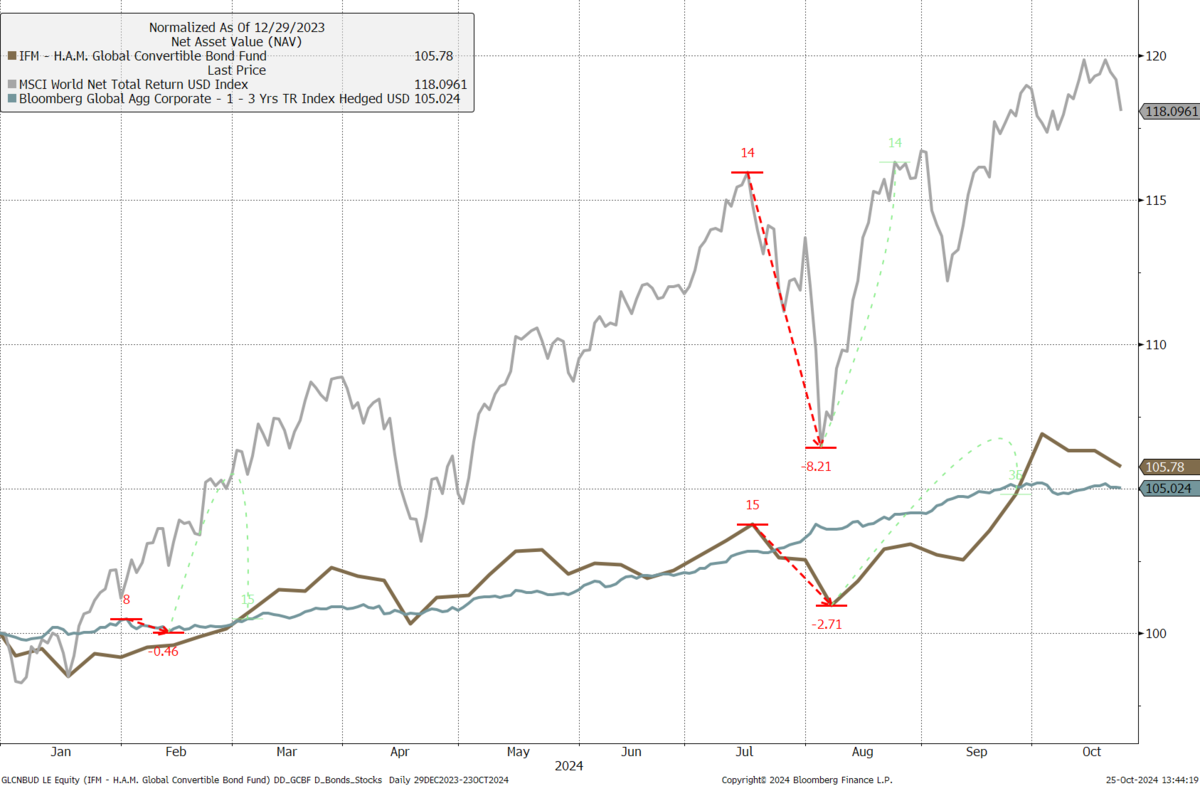

Since beginning of the year 2024:

Source: Bloomberg Finance L.P., 24.10.2024

In August of this year, the markets experienced a significant downturn, driven by growing recession fears due to weak economic data in the U.S. This led to a strong appreciation of the JPY against the USD, which caused record losses in the Japanese stock markets. Even the previously high-demand U.S. tech stocks came under significant pressure.

In this environment, global equities, as measured by the MSCI World Net Total Return USD (grey), corrected by up to -8.21%. In contrast, the H.A.M. Global Convertible Bond Fund USD-D (brown) was able to cushion the losses much more effectively, with a decline of just -2.71%, showcasing its convex characteristics. Global bonds, represented by the Bloomberg Global Aggregate Corporate 1-3y Total Return Index USD (blue), benefited from rapidly falling interest rates.

Apart from the pronounced drawdown in August, equity markets have shown an overall positive trend so far this year. However, when adjusting the performance of the U.S. benchmarks to exclude the disproportionate influence of the «Magnificent 7» – including Apple Inc., Microsoft Corp., Meta Platforms Inc., and Nvidia Corp. – the performance appears much more moderate: The Nasdaq 100 Equal Weighted Index recorded around +7%.

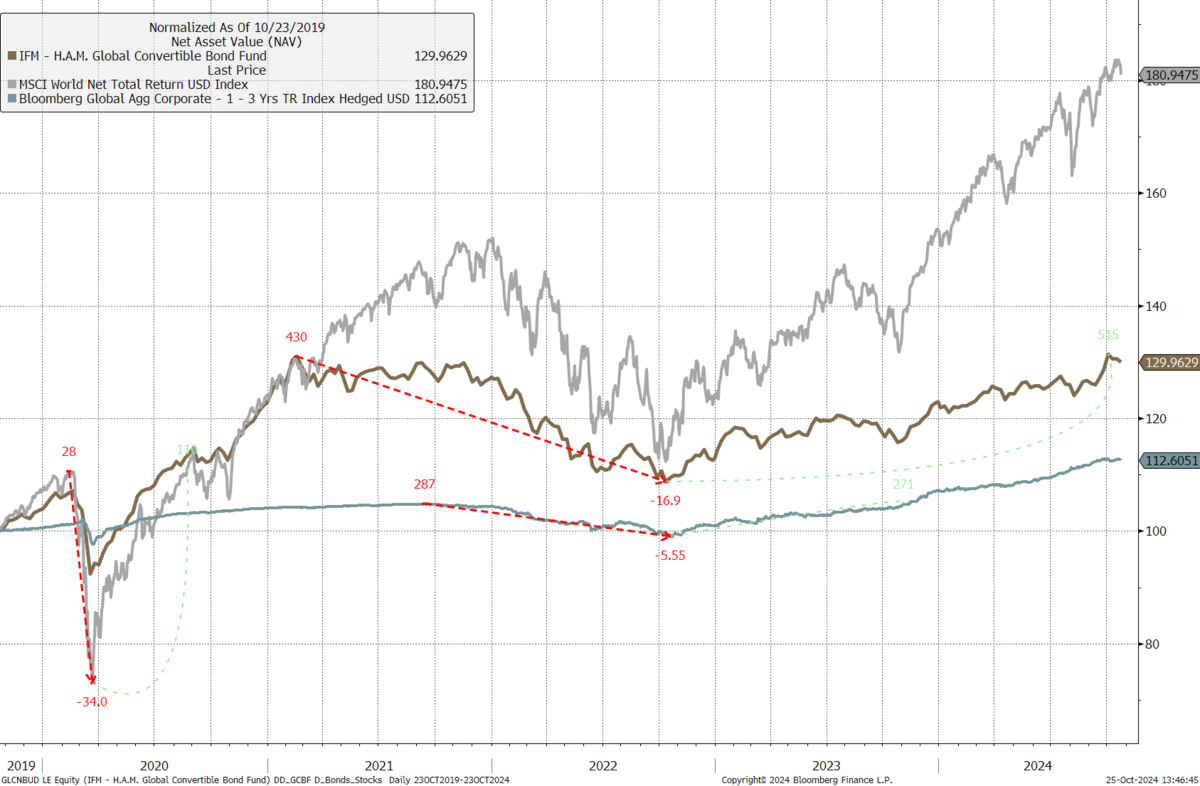

Over 5 years:

Source: Bloomberg Finance L.P., 24.10.2024

In the long run, it is evident that the maximum drawdown of the H.A.M. Global Convertible Bond Fund was significantly lower at -17% compared to global equities, which saw a maximum loss of -34%. Despite having moderate equity sensitivity, the fund was able to keep pace with stock market performance until the end of 2020, when the extraordinary rise of large-cap U.S. tech companies, which are not typically present in the convertible bond universe, began.

Nevertheless, global convertible bonds also experienced significant gains, which met expectations, given a delta clearly below 1, and outperformed traditional bonds by a wide margin.

Convertible Bonds in the Current Environment: A Compelling Opportunity

Despite upcoming U.S. presidential elections, geopolitical uncertainties, trade conflicts between the U.S., China, and Europe, and heightened volatility during earnings season, major equity indices continue to reach new highs. This is supported by central banks' announced easing measures and positive economic developments.

Given this backdrop, convertible bonds, with their asymmetric characteristics, present an attractive option for benefiting from potentially rising equity markets while mitigating risk in the event of a market downturn due to the various event risks.